Accountants and Business Advisors

Connect your clients to the right funding

Funding Options for Advisors

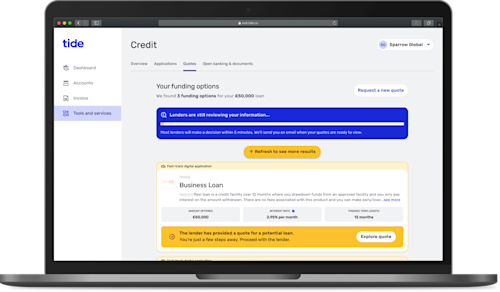

Forward-thinking accountants and advisory professionals are indispensable to their clients, providing forecasting and growth support as well as traditional accounting services. With Funding Options you can now ensure your clients access the right funding so they can trade, plan and grow with confidence.

Why partner with us?

Access to 120+ lenders

We work with a rapidly growing panel of 120+ top lenders from high-street banks to niche AltFi providers, offering the broadest range of finance solutions available.

Finance Specialist Support

An experienced team of finance specialists are on hand to help you or your clients if needed.

Referral Model

We offer a competitive revenue share for every successful customer referred.

Instant funding decisions

Get pre-approved offers in seconds and funds in the bank within as little as 18 minutes.

To find out more about becoming a partner, download the business introducer pack.

Download nowWork with us

Become a partner of Funding Options. Enquire today and a member of the partnerships team will be in touch shortly.

How does it work?

Our award-winning technology searches the market to accurately and quickly match customer needs with the right lender and finance option.

Apply online to become a partner

Your dedicated partnership manager will help you get onboarded to Funding Options

Complete applications on behalf of your clients

Receive referral commission for every for every successful referral

Help your clients get to grips with finance

Download our business finance guides and support your clients in understanding the types of facilities, how to get finance, their requirements and more.

DownloadWant to know more?

Have a look at our FAQs.

How long will it take to get finance?

Our fastest case was completed in 18 minutes, from initial enquiry to funds in the business's bank account. Our record from enquiry to approval is 20 seconds. In our experience, the biggest factor in how quickly you’ll get finance is you. Most lenders will reply quickly (within 24 hours), and your dedicated account manager will work hard to keep things moving. If you’ve got all the documentation ready, it’s often possible to get the deal done within a day or two. First, you’ll need to give us the key details about your business and what you’re looking for. This will only take a few minutes, and you can do it on our website or give us a call. Once you’ve decided which lender(s) you’d like us to approach, the application time varies depending on the product and lender you’re dealing with – but it always helps if you’ve prepared in advance! The lenders we work with are much faster than the banks . It takes seconds to see your options . Offers are back within 24–48 hours for most cases. The money could be in your account within days if you’ve got documents ready.

What products are available?

Types of commercial finance available include bank term loans, invoice finance, hire purchase, equipment leasing, commercial mortgages, property development finance, peer-to-peer lending, revenue loans, and online short-term lenders, as well as government-backed start-up loans and not-for-profit social lenders.

Funding Options does not support equity funding.

Will you do a credit check?

Signing up on our website, seeing your funding options, and talking to one of our Business Finance Specialists won’t have an effect on your credit score. We, Funding Options, do not credit check you. However, many of the lenders we work with require a credit check as a normal part of their application process. For this reason, we may ask for your ‘permission to search’ to pass on to a lender in order to speed up your application and make the process as straightforward for you as possible. You will never be credit checked by a lender we work with unless you have given your explicit consent. Personal credit checks are highly regulated, and you have rights as an individual for your personal data to be protected. If you have any questions about credit checks and permission to search in relation to your finance enquiry, one of our team will be happy to discuss it further with you

Will you recommend a product?

No, we cannot recommend products and we don’t give financial advice. Our service is all about finding the funding options that your business is eligible for, and matching them with your requirements and requests. We can give you information on each of your options, explain how they work, and clarify exactly what you’d be agreeing to; but you have to make the decision.

How do you make money?

Using our service is completely free and no-obligation, and we don't charge our customers a fee. You can use our matching tool, look at your options, or speak to one of our Business Finance Specialists with no strings attached. If you decide to go ahead, and a lender accepts your application for finance, they pay us a commission based on our standard terms. Normally, the cost to our customers is the same as if they’d gone direct to the lender.

We’re happy to disclose further commission details on request – if there’s anything else you’d like to know, feel free to get in touch.

Can you help startups?

We endeavour to help every UK business, but startups can be a little more challenging to help because they don’t have a track record or any assets to secure lending against. Some lenders won’t lend to startups, but since we work with over 120 finance providers there are often other ways of getting funding – for example, funding equipment directly with an equipment lease, rather than getting a general growth loan.

We also work with Startup Direct, a government-backed organisation that supports startups with finance and mentoring in partnership with the Start Up Loans scheme. Through them, businesses can get loans up to £25,000 – and after a few months of trading they might be eligible to get other types of funding like asset finance and invoice finance.